|

|

||

|

|

||

|

The future of globalization Although its votaries have sought to present globalisation as a triumphant process to which there has been no serious challenge, the truth is that at every juncture when a crisis has occurred since the 1990s (when the present phase of globalisation emerged), questions have been raised about its vulnerability. Now that the global economy is beset by its worst crisis since the 1930s Great Depression, there will be doubts about the future of globalisation. Biswajit Dhar THE economic crisis that has besieged the world since the onset of the COVID-19 crisis has raised some searching questions about the future of globalisation. Several Western commentators have been seriously engaged on whether the pandemic would sound the death knell for globalisation1 or, at the very least, undermine the elaborate global value chains or production networks that have become its hallmark.2 This question is hardly a new one; since the middle of the 1990s, or from its very early days, many have cast doubt about the future of globalisation.3 The economic recession in 2008 brought fresh doubts about globalisation, with some narrowing the problem down to financial globalisation.4 Falling demand caused investment to fall, but the dramatic declines in trade resulted from ‘strongly synchronised drops in trade across countries’ that resulted in combined effects of several factors.5 Although the excessive financialisation of economies was identified as the principal factor that caused the domino collapse of the financial system and the subsequent contagion, the systemic risks of financialisation were never addressed, despite the frequent shocks that it imparted to the real sector. This impact on their real sectors during the earlier episodes of crisis often raised the spectre of countries decoupling from the process of globalisation, but since these downturns were shortlived, countries remained engaged. The economic crisis triggered by COVID-19 has been of a very different order, and, therefore, the questions being asked about the future of globalisation seem more pertinent than ever. There are several reasons for this. From early signs of the economic stress that the pandemic is likely to cause, the world economy looks uncomfortably similar to that in the 1930s, when the Great Depression struck. The International Monetary Fund (IMF) has predicted that the ‘Great Lockdown’ could be the worst economic recession since the Great Depression, pulling down the global gross domestic product (GDP) in real terms by 3% in 2020. Advanced economies could experience a 6.1% fall in real GDP, while the emerging market and developing economies could see their GDP decline by 1%. The IMF’s prediction was that the global economy would have a ‘V-shaped’ recovery, with a sharp increase in output of nearly 6% in 2021, which would be contributed to by a 5% increase in output of the advanced economies and a 9.2% and 7.2% increase by China and India respectively. But two months after the IMF’s predictions were unveiled, the prospects for the global economy are looking distinctly much worse. The increasing strains on the global economy are currently much larger than what the IMF had predicted. In the past too, the organisation had erred in making predictions about global growth, especially when it mattered – in times of downturn. For instance, in the midst of the Great Recession in 2008, the IMF had predicted that the global economy would expand by 3% in 2009, but the global economy actually contracted by 0.5%. These estimates of the impact of COVID-19 on global GDP inform us that the impact of the pandemic would be far less than that experienced during the Great Depression, when contraction of global GDP between 1929-33 was over 15%.6 Recent estimates indicate that in 2020, the global economy could decline by 4.6%, with the US economy contracting by 5.6% and China remaining flat. Other emerging economies could decline by 4.5%, and the Indian economy is likely to experience a 5% contraction.7

That the global economy would face serious headwinds in 2020 has also been predicted by the World Trade Organisation (WTO), which has estimated a fall in world trade volumes of 13-32%. COVID-19 has brought in such levels of uncertainty that its impact can best be explained only through a very wide range. But, the WTO’s worst-case scenario of trade volume decline in 2020 is significantly worse than the impact of the Great Depression on trade; between 1929 and 1932, trade volumes declined by almost 25%. While there is hardly a doubt that the world economy is facing a crisis, which, as mentioned above, could be even more severe than what the 1930s had seen, the critical question is whether this downturn would undermine the future of globalisation. In recent weeks, several observers have tried to view the challenges that the process of globalisation faces from several different perspectives. There have been arguments that the world economy is going through a phase of ‘slowbalisation’ or even ‘deglobalisation’, but these tendencies are not likely to sound a death knell for the phenomenon. Some others have sounded a more sombre note, pointing out that the pandemic has made countries aware about the vulnerabilities that they suffer from in an interconnected world. Major economies have responded in varied ways to address their vulnerabilities by announcing stimulus packages. The question is whether these policy responses their vulnerabilities by announcing stimulus packages. The question is whether these policy responses could serve the cause of globalisation, which, according to some authors, they must. The pre-COVID phase witnessed the most serious economic rivalry since the middle of the previous century, with both the United States and China trying to gain ascendancy. Could the contours change after the global economy recovers from the pandemic? This article will try to reflect on the aforementioned issues. ‘Slowbalisation’ and ‘deglobalisation’? In 2016, the Dutch writer Adjiedj Bakas coined the term ‘slowbalisation’ to capture the sluggishness that the process of globalisation had developed. This term gained a degree of popularity as it captured the state of the global economy, which never seemed to recover after being jolted by the Great Recession of 2008. Others like O’Sullivan passed the judgement that ‘globalisation is already behind us’. What then is the reality? Our attempt to get to the reality will hinge on exploring the underlying processes of globalisation. To do so, we will provide a brief account of the basic framework behind this phenomenon, which will aid in contextualising our exploration. The latest phase of globalisation8 should ideally be marked from the adoption of the Washington Consensus. In its essence, the conceptual underpinnings of globalisation were provided by the Washington Consensus, a term that John Williamson used to describe a set of 10 prescriptions ‘originally presented as a summary of what most people in Washington believed Latin America (not all countries) ought to be undertaking as of 1989 (not at all times)’.9 The common feature of these policies was deregulation and opening up of markets to both foreign trade and investments. Interpretations of the elements of the package, however, did not enjoy the desired degree of consensus. While Williamson argued that the liberalisation of foreign investment was only limited to foreign direct investment,10 several others were not quite as definitive about this policy.11 If the beginning of the 1990s is taken as the period from which globalisation took root when most developing countries ‘embraced Consensus style reforms, with the strong support from international institutions, particularly in the context of IMF stabilisation programmes and policy-based lending programmes of multilateral development banks’, the process had an uncomfortable initiation. Almost immediately afterwards, the Mexican peso crisis in 199412 and the East Asian financial crisis in 1997 were harbingers of global uncertainties, the latter resulting in the first major contagion, affecting economies beyond the region.13 In effect, therefore, the ‘golden years of globalisation’ were the period after the turn of the millennium and until the Great Recession made its impact felt. More appropriately, the quinquennium 2003-07 should ideally be considered since the two years preceding it were influenced by the economic uncertainties following 9/11. Between 2003 and 2007, the average growth of global GDP was over 5.1%, which was significantly higher than in any other comparable period since 1980. The advanced countries grew by nearly 3%, while the emerging market and developing economies grew by slightly less than 8%. In the decade of the 1990s, the global economy grew by just over 3%, while the developed and emerging market and developing economies grew by 2.8% and 3.6% respectively. Individual countries, too, registered high growth rates. Among the emerging economies, India registered its highest ever growth rate for a quinquennium, at nearly 9%, and so did Brazil (4%). China grew at nearly 11%, which was slightly below its highest rate of growth registered in the first half of the 1990s. The European Union expanded by 2.2%, exceeding its 2% growth after it was formed in 1992. The post-2008 period was a sharp contrast to the earlier period. Tables 1-3 show that all economies without exception experienced a perceptible slowdown, supporting the argument that ‘slowbalisation’ had indeed become the rule. The tables show that even before COVID-19 spread across the world resulting in the ‘Great Lockdown’, all the major groups of countries and individual economies had completely lost their momentum. Average growth of global GDP had declined from 4.5% in the years prior to the Great Recession to 3.5% during the past five years. China, one of the key drivers of the global economy, saw its growth rate drop from an annual average of nearly 12% during 2003-07 to less than 7% during 2015-19. In the 2000s, India had recorded its highest ever growth, averaging about 9%, and it had also registered double-digit growth for the only time in development history in 2010, but its average annual growth for 2015-19 had slowed down to below 7%.

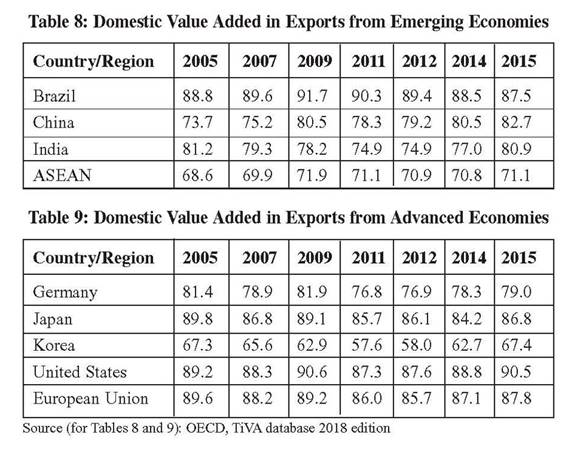

The major economies showed similar patterns of having left their high-growth phase behind. The United States grew at 3% before the 2008 recession, while Japan grew at less than 2%. But from thereon, they suffered a discernible slowdown; the United States grew by 2.4% since the middle of the previous decade, while Japan grew by just 1%. If growing economies encouraged the forces of globalisation to expand and also provided the impetus to sustain the growth momentum, the slowing down of the major economies dampened the entire sequence. This was most visible through the impact that the slowdown had on trade and investment flows in an interconnected world. Tables 4 and 5 show the changes in the dynamics of global trade that took place between the so-called ‘golden period of globalisation’, the years between 2003 and 2007, and the last decade, when the global economy showed a perceptible slowdown. The tables show that growth of merchandise trade has been declining consistently from the ‘golden period of globalisation’ in every economy. The most severe slowdown of trade was registered by India, its trade growth slowing from an annual average of over 29% during 2003-07 to 1.4% since 2015. The largest trading nation, China, also suffered a similar decline in trade growth, from nearly 29% to less than 2% during the same period. The United States, the second largest trading nation, saw its trade growth slowing from an annual average of 11% to just 1%. Among the emerging economies, Russia’s trade grew almost as fast as that of China’s during the 2000s, but by the second half of the previous decade, its trade had begun to contract. The slowing down of trade was not the most troubling element for globalisation; it was the decoupling of some of the major economies from trade in recent years – in other words, the trade openness of these countries has declined (Tables 6 and 7). Two patterns of trade-to-GDP ratios are clearly discernible from the tables. All emerging economies in Table 6 went through a reduction in trade openness, with Malaysia experiencing a steep fall of its trade-to-GDP ratio from over 220% in the year 2000 to just over 130% in 2018. China’s trade-to-GDP ratio peaked at about 65% in 2006, but by 2018, the ratio had come down to 38%. During the last three years for which data are presented in the table, China’s trade openness was the lowest in two decades. India’s trade expansion continued until the beginning of the last decade, raising the trade-to-GDP ratio to 55%, but a tepid growth in trade subsequently caused the ratio to decline to about 40% in 2016. Table 7 shows that among the advanced economies, the European Union and most of its member states consistently became more open to trade, with the exception of the years in which the impact of the Great Recession was visible. Korea and the United States became less open, with the former experiencing a significant reduction in its trade openness. These trends are indications that over several of the major economies, the trend towards globalisation was reversing, in some cases quite significantly so. Further evidence of this trend was the manner in which global value chains (GVCs) have performed over the past several years. One of the most striking features of the process of globalisation was the emergence of GVCs. The slicing and dicing of production across national borders has contributed to the networking of goods and services and as a result, trade has grown much faster than production in the countries participating in the GVCs. Trade liberalisation has immensely contributed to the proliferation of the GVCs, but perhaps more important has been the expansion of improved logistical and communication services and efficient trade facilitation that have helped in reducing transaction costs. The GVCs, whose efficiencies are determined by their ability to use ‘just-in-time’ strategies, are sensitive to any disruptions in the enabling environment that supports them. Not surprisingly, therefore, periods of global economic uncertainty disrupt the functioning of the value chains, which in turn causes significant decline in trade volumes. The WTO’s estimate that trade volumes could decline by as much as 32% during the current year, factors in the disruption in GVCs caused by extensive lockdowns and the consequent downswing in economic activities. While several commentators have also spoken of the adverse impact on GVCs and therefore on global trade, there is evidence that the GVCs had been shrinking as the global economy struggled to recover from the impact of the Great Recession. The evidence of this phenomenon is provided by the WTO-OECD database on Trade in Value Added (TiVA). The TiVA database provides statistics on the contributions made by different countries and industries in the trade of a given country. In simple terms, the database allows us to segregate the exports of a country in terms of value added domestically and from the rest of the world. Thus, it helps in understanding the contribution that GVCs are making in the exports of the countries included in the database. In this article, we use the 2018 TiVA database to gauge the extent to which exports of major trading countries depend on the GVCs or production networks. This database covers the period 2005-15. The domestic value added in exports of emerging and advanced economies is captured in Tables 8 and 9. The countries included in the tables include some of the countries and regions, like China and members of the Association of South-East Asian Nations (ASEAN), which have extensively participated in GVCs.

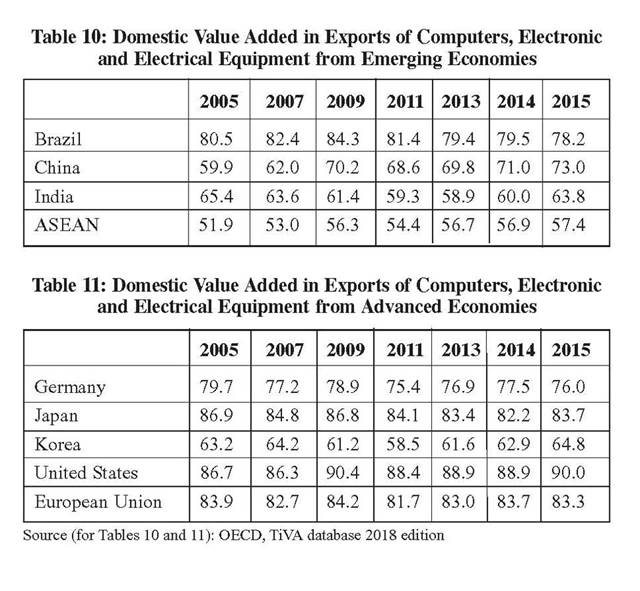

The two tables show two striking features of value-added exports: firstly, all the economies covered in the tables depend overwhelmingly on domestic value addition, and secondly, domestic value addition in 2015 was higher than in many of the other years for which data are captured in the tables. What this implies is that during the period 2005-15, there have been one or more years in which the domestic value addition was lower for each of the countries, but by 2015, domestic value addition had increased. This is an indication that though each of the countries had taken steps towards greater global integration during the period 2005-15, they had also taken some steps back by the terminal year. The above findings need to be substantiated using data from industries in which GVCs have been more successful. These industries include those producing computers, electronic and electrical equipment. Tables 10 and 11 provide the trends in domestic value addition in these industries. The trends of domestic value addition for computers, electronic and electrical equipment captured in these tables are no different from the trends for overall exports. Especially striking is the trend for China, in which domestic value addition grew from less than 60% in 2005 to 73% in 2015. Equally significant was the rising domestic value-added trend for ASEAN members, increasing from about 52% to 57%. These trends would have got strengthened in the more recent years, as some countries, including India, have introduced policies to enable higher value addition in these industries. The challenges that the process of globalisation has faced are quite evident, as the data presented above have shown. There are two facets to the process that we have highlighted in our discussion. The first is that the benefits from globalisation in terms of higher growth rates, which have been one of the main arguments for greater global integration of economies, are not supported by the evidence presented in this article. In fact, most countries experienced declining growth rates, giving credence to the argument about ‘slowbalisation’ of the global economy. Secondly, GVCs were considered as the drivers of globally integrated economies, but with production and exports becoming increasingly domestically oriented as we have shown, globalisation faces considerable uncertainties.  The response of the major economies to the COVID-induced crisis would exacerbate the uncertainties for globalisation. All the economic stimulus packages announced thus far have one common feature: they are all aimed at reviving the domestic economies. The disruption of GVCs, and the consequent supply shortages that countries have faced, are the factors forcing countries to adopt policies that could result in further decoupling from the international markets. The following section provides an overview of the measures taken by a selected set of countries. Economic stimulus packages and their implications for globalisation We could consider the announcements made by the United States and India and their orientation towards stimulating domestic industries. US initiatives to revive the economy The US has led the way by adopting the Coronavirus Aid, Relief, and Economic Security (CARES) Act.14 The CARES Act has proposed an injection of $2.2 trillion, or about 10% of the country’s GDP. This stimulus package dwarfs the $831 billion stimulus provided by the American Recovery and Reinvestment Act of 2009 to bail out the US economy from the depths of the Great Recession. In addition, the US Federal Reserve has taken further steps to provide up to $2.3 trillion in loans to support the economy, including support for small and mid-sized companies.15 Large corporations and small businesses, taken together, were the largest beneficiaries. The CARES Act committed $500 billion in the form of loans and loan guarantees, and other investments. $350 billion was authorised to small businesses, or those with 500 or fewer employees. As has always been the case with initiatives taken by the US government to revive the economy, several US agencies have announced a slew of programmes, all of which are aimed at reviving the industries in the country. The Export-Import Bank of the US (EXIM) announced the ‘Strengthening American Competitiveness’ initiative which ‘focuses on supporting transformative US exports and jobs, advancing America’s comparative leadership in the world, and competing with China in the global marketplace’.16 The initiative focuses on several key sectors, including renewable energy, wireless communication (5G), biotechnology and biomedical sciences, artificial intelligence, including quantum computing, emerging financial technologies and space technology. EXIM received a seven-year reauthorisation from the US Congress in December 2019 which directed EXIM to establish a new ‘Program on China and Transformational Exports’.17 The purpose of this ‘program is to support the extension of loans, guarantees, and insurance, at rates and on terms and other conditions, to the extent practicable, that are fully competitive with rates, terms, and other conditions established by the People’s Republic of China’. The US government has therefore expressed its intent to support its own industries to compete with China in the global markets. Government of India’s economic revival package In May, the Government of India announced a Rs. 20 trillion economic package for reviving the economy,18 which, according to recent projections, could shrink in the current fiscal year (April 2020 to March 2021). An important component of the policy pronouncements made alongside the announcement of the package is to promote self-reliance by focusing on domestic production. As a step towards realising this objective, the government revised its public procurement rules to encourage ‘Make in India’ and to promote manufacturing and production of goods and services in India. The new rules provide that ‘local content can be increased through partnerships, cooperation with local companies, establishing production units in India or Joint Ventures (JV) with Indian suppliers, increasing the participation of local employees in services and training them’.19 Subsequently, several administrative ministries issued separate notifications interpreting the abovementioned order for their ministries. These include the Ministry of Electronics and Information Technology20 and the Ministry of Chemicals and Fertilizers.21 Another critical initiative for promoting self-reliance was the announcement by the Department of Pharmaceuticals to encourage domestic manufacturing of key starting material (drug intermediates) and active pharmaceutical ingredients (APIs) by ‘attracting large investments in the sector to ensure their sustainable domestic supply and thereby reduce India’s import dependence on other countries’.22 In order to meet these objectives, the Government of India announced incentives for up to six years. This policy is aimed at reducing India’s import dependence on China for APIs. Over the years, India has become heavily dependent on China for APIs, and in some of the important categories, especially in the case of a number of antibiotics, China accounts for more than 90% of India’s imports. Through this series of policy pronouncements, the Government of India has unambiguously announced its decision to promote local manufacturing and reduce the import bill. While several of the notifications were limited to public procurement activities, the notification on pharmaceuticals would have a wider impact. The initiatives that the US and Indian governments have taken to stimulate their economies through encouraging local production would result in decreasing their countries’ imports. If the policy pronouncements are successfully implemented, these two large markets could see considerable backsliding from globalisation. Several other countries, for instance, Germany, have also given priority to local manufacturing in their stimulus packages, and if this trend takes firm root, deglobalisation seems more imminent. A possible China-centred globalisation post-COVID? Since early April, news has been filtering through that China’s manufacturing sector is getting back on track. Other countries will remain in a lockdown phase for at least another two months. Nobody is yet talking of the flattening of the curve, and after that happens, it will take some more time for normalcy to return in most major economies. With China getting a lead over others in kickstarting its economy, there is a distinct possibility that it would be able to further consolidate its position in the global economy. One interesting feature of China’s global economic integration, especially during the past two decades, is that after each crisis that the global economy has experienced, China has been able to consolidate its position. In the post-9/11 world, which also coincided with China joining the WTO, China was able to expand its share in global exports by a fair margin from below 3% to over 7% in 2005. After the 2008 recession, China increased its share to over 11% by 2012. Similarly, it enhanced its share in global manufacturing value added from below 8% in 1999 to 11.5% in 2005 and to over 20% in 2012. By 2018, China contributed a quarter to global manufacturing value added. The probability of yet another round of Chinese consolidation is on the cards for the reasons stated above. China’s capacity to dominate the global stage has also been enhanced by a leader who has embraced globalisation.23 President Xi Jinping has thus adopted a stance that is radically different from that of the founding father of China’s market-based reform, Deng Xiaoping. While Deng adopted the market philosophy without really admitting it,24 Xi has not only accepted globalisation but set his sights on playing a dominant role in the process. In May, the Report on the Implementation of the 2019 Plan for National Economic and Social Development and on the 2020 Draft Plan for National Economic and Social Development was presented before the Third Session of China’s Thirteenth National People’s Congress.25 This provided an opportunity for China to present its development plans with a forward-looking strategy, when most economies were grappling with the uncertainties of the present. This scenario could, undoubtedly, be a new normal for globalisation. The question which then arises is: would the major economies, the votaries of globalisation in the past, accept this new normal? Biswajit Dhar is a Professor at the Centre for Economic Studies and Planning, School of Social Sciences, Jawaharlal Nehru University in New Delhi. Endnotes 1 Farrell, Henry and Abraham Newman (2020), ‘Will the Coronavirus End Globalization as We Know It?’, Foreign Affairs, 16 March 2 Beattie, Alan (2020), ‘Will coronavirus pandemic finally kill off global supply chains?’, Financial Times, 28 May 3 Haass, Richard N and Robert Litan (1998), ‘Globalization and Its Discontents’, Foreign Affairs, May/June 1998. 4 Huwart, Jean-Yves and Loïc Verdier (2013), ‘The 2008 financial crisis – A crisis of globalisation?’, in Economic Globalisation: Origins and Consequences, OECD Publishing, Paris. 5 OECD (2010), Measuring Globalisation: OECD Economic Globalisation Indicators 2010, Paris, p. 40. 6 Crafts, Nicholas and Peter Fearon (2010), ‘Lessons from the 1930s Great Depression’, Oxford Review of Economic Policy, Volume 26, Number 3, pp. 285-317 (Table 1). 7 Fitch Ratings (2020), ‘Further Economic Forecast Cuts but Global Recession Bottoming Out’, 26 May. 8 The earliest phase of globalisation occurred during 1870-1914, the period of the gold standard. Some commentators consider the period from 1945 as a long continuum encompassing globalisation, which ended with the Great Recession, but the pre-1980s phase was one in which only the developed countries opened their economies while the developing countries, in general, did not undertake liberalisation of trade and capital flows. For an explanation of the two phases of globalisation, see Irwin, Douglas A (2020), ‘Globalization is in retreat for the first time since the Second World War’, Peterson Institute for International Economics, 23 April 9 Williamson, John (2002), ‘Did the Washington Consensus Fail?’, Peterson Institute for International Economics 10 Williamson, John (1990), ‘What Washington Means by Policy Reform’, in John Williamson (ed.), Latin American Adjustment: How Much Has Happened?, Institute for International Economics, Washington, D.C., Chapter 2. 11 Birdsall, Nancy et al. (2010), ‘The Washington Consensus: Assessing a Damaged Brand’, World Bank Policy Research Working Paper 5316, p. 8. 12 Griffith-Jones, Stephany (1997), ‘Causes and Lessons of the Mexican Peso Crisis’, WIDER Working Papers (1986-2000) 1997/132, UNU-WIDER, Helsinki. 13 Walker argued that although the peso crisis had spread to other countries in the Southern Cone, ‘Mexico’s proximity to the United States and the Clinton administration’s commitment to NAFTA made the United States effectively a lender of last resort to Mexico’, which prevented the crisis from deepening. In contrast, the East Asian region lacked a lender of last resort. Walker, W Christopher (1997), ‘Contagion: How the Asian crisis spread’, EDRC Briefing Notes, Number 3, Asian Development Bank, Economics and Development Resource Center, October 1997. 14 Coronavirus Aid, Relief, and Economic Security Act, Pub. L. 116-136. 15 Federal Reserve System (2020), ‘Federal Reserve takes additional actions to provide up to $2.3 trillion in loans to support the economy’, 9 April 16 EXIM (2020), ‘EXIM Launches “Strengthening American Competitiveness” Initiative’, 6 May 17 EXIM (2020), ‘Overview: Program on China and Transformational Exports’, 13 May 18 Prime Minister’s Office (2020), ‘PM gives a clarion call for Atmanirbhar Bharat (self-reliant India)’, Press Information Bureau, 12 May 19 Government of India (2020), ‘Public Procurement (Preference to Make in India), Order 2017 – Revision; regarding, Department of Industrial Policy and Promotion’, 28 May. The detailed rules for the implementation of this order were provided on 29 May 20 Ministry of Electronics and Information Technology (2020), ‘Notifications for Electronic Products under Public Procurement Order 2017’, 2 June 21 Ministry of Chemicals and Fertilizers (2020), ‘Mandatory Public Procurement of Chemicals and Petrochemicals to boost Manufacturing and Production of Goods, Services and Works to promote Make in India’, 2 June 22 Ministry of Chemicals and Fertilizers (2020), ‘Production Linked Incentive (PLI) Scheme for promotion of domestic manufacturing of critical Key Starting Materials (KSM)/Drug Intermediates and Active Pharmaceutical Ingredients (APIs) in India’, Department of Pharmaceuticals, 2 June 23 Parker, Ceri (2017), ‘China’s Xi Jinping defends globalization from the Davos stage’, World Economic Forum, 17 January 24 Deng never admitted having introduced the market economy, for he professed ‘socialism with Chinese characteristics’. It was President Jiang Zemin who introduced the term ‘socialist market economy’ in 1992, bringing the leadership closer to accepting the reality. *Third World Resurgence No. 343/344, 2020, pp 56-63 |

||

|

|

||